Vietnam’s Technology Sector: An Emerging Investment Frontier

Vietnam’s technology sector is experiencing rapid growth, driven by a young and tech-savvy population, favorable government policies, and substantial foreign investment. This expansion is driven by advancements in IT software & services, as well as the burgeoning semiconductors.

Sector growth landscape & Investment opportunities

Vietnam’s software & IT services market

Vietnam has rapidly evolved into a global hub for digital innovation, driven by strong demand in e-commerce, financial technology (FinTech), and AI-powered solutions. This expansion is largely fueled by strategic government initiatives, such as the National Digital Transformation Program by 2025, which focuses on infrastructure development, digital skills training, and attracting investment in key sectors, with a vision toward 2030. Vietnam is rapidly emerging as a key player in the global AI landscape, driven by major recent investments and strategic partnerships, such as:

- Leading Vietnamese tech firms, including FPT, Viettel, CMC Corp, and VNPT, have formed strategic partnerships to accelerate AI innovation.

- NVIDIA’s establishment of its third global AI R&D center (VRDC) in Vietnam last year, marking a significant milestone in the country’s AI development.

- NVIDIA’s acquisition of VinBrain further strengthens Vietnam’s position in AI-driven healthcare and smart technology solutions.

Vietnam offers concrete advantages that create opportunity – a stable political climate with strong government support and a growing AI ecosystem already engaging top global companies, aligning with the global AI investment boom and solidifying Vietnam’s status as a rising AI and technology hub in Southeast Asia.

According to the Ministry of Planning and Investment, Vietnam aims to become a leading center for AI research and application in the region, with the specific goals of training 7,000 AI experts and nurturing 500 AI startups by 2030. This burgeoning ecosystem offers diverse avenues for both tech and non-tech entities. Foreign tech firms can strategically partner with agile local tech companies to accelerate market entry and leverage local expertise, or invest in developing specialized AI talent through tailored training programs or establish R&D centers. Whereas, non-tech companies can partner with growing Vietnamese AI startups for industry-specific applications, and establish innovation labs to benefit from lower development costs while accessing specialized talent.

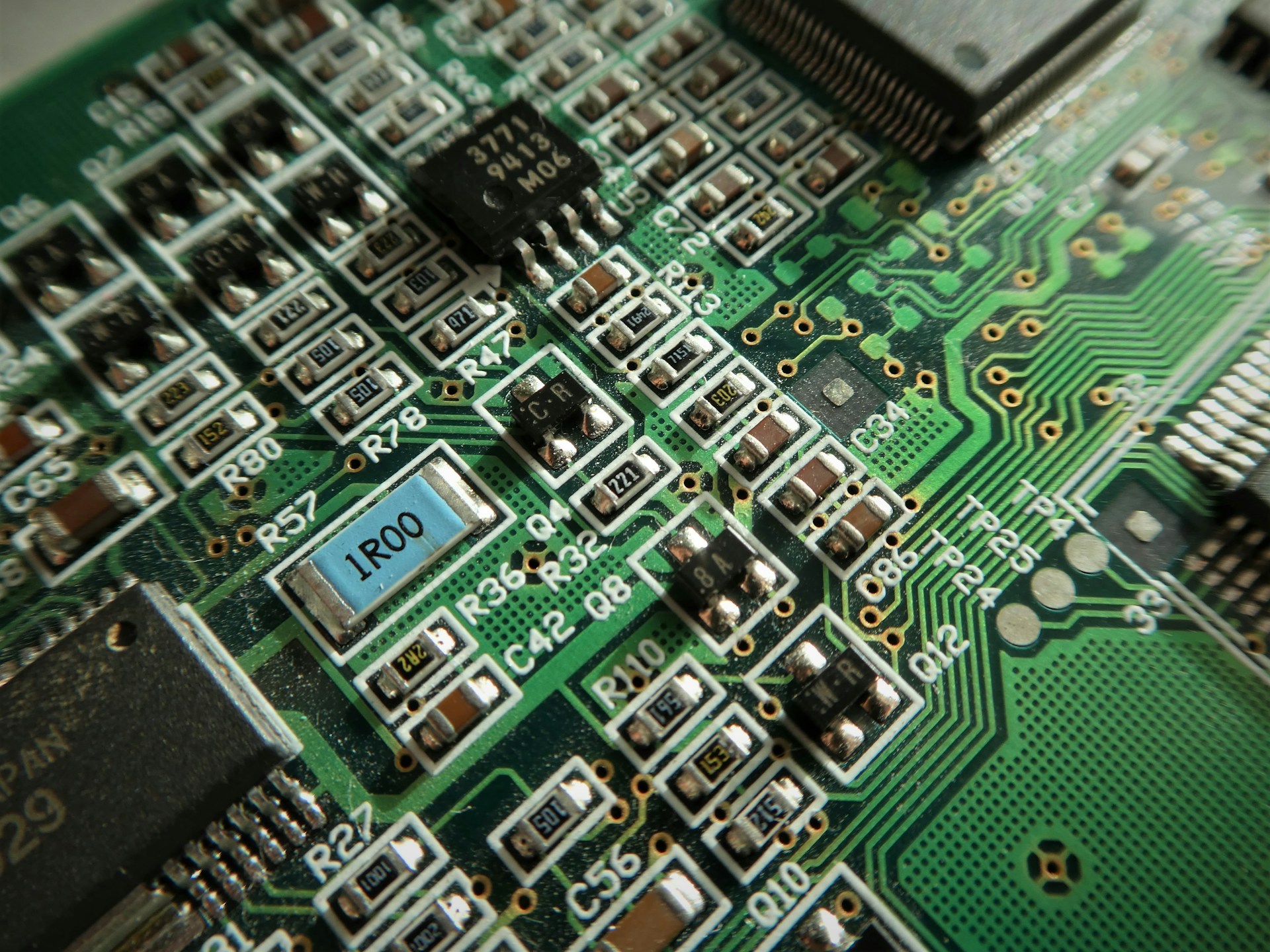

Vietnam’s semiconductor market

Vietnam’s semiconductor industry is rapidly expanding, fueled by growing chip demand across multiple sectors and proactive government policies. According to the Ministry of Information and Communications (MIC) forecasts, the Vietnamese semiconductor industry is estimated to be valued at US$20-30 billion by 2030. This growth trajectory aligns with the global semiconductor market’s anticipated surge to $1 trillion by 2030, driven by the rapid expansion of industries like electric vehicles, telecommunications, cloud computing, and AI.

While Vietnam’s semiconductor supply chain is currently in its nascent stages, primarily focused on chip design and assembly, packaging, and testing, the projected market growth presents significant opportunities for expansion. Vietnam’s competitive labor costs, an increasing pool of semiconductor engineers, and strong government incentives, including tax breaks and infrastructure investments, further bolster its potential to capitalize on this global boom. To actively strengthen its semiconductor ecosystem and leverage these opportunities, the Vietnamese government has launched key initiatives, such as:

- Decision 1018/QD-TTg (dated September 21, 2024): Aiming to attract FDI, boost domestic chip design & manufacturing, and strengthen R&D.

- The National Semiconductor Development Strategy (2024–2030) follows the “C=SET+1” framework: Outlining a three-phase roadmap through 2050 to expand Vietnam’s semiconductor industry. (C stands for Chip, S for Specialized, E for Electronics, T for Talent, and +1 represents Vietnam’s role as a safe, emerging destination in the global supply chain)

By 2030, Vietnam aims for 100 chip design firms, one fabrication plant, 10 packaging & testing facilities, and 50,000 semiconductor engineers. As of November 2024, the country already has 50 chip design firms and seven packaging & testing facilities. The Ministry of Planning and Investment is actively working with global tech leaders like Google, Meta, AIChip, Lam Research, Qorvo, and Qualcomm to shift semiconductor supply chains to Vietnam. Currently, there are 174 semiconductor-related FDI projects totaling $11.6 billion, supported by tax breaks, land incentives, and R&D grants.

Vietnam’s digital infrastructure and investment incentives

Vietnam’s digital infrastructure development

Vietnam’s digital transformation is powered by a rapidly modernizing telecom infrastructure, strongly supported by strategic government initiatives. The Digital Infrastructure Strategy 2025–2030 positions telecommunications as the “backbone of the economy,” with particular focus on nationwide digital connectivity. Recent key achievements include:

- Fixed broadband speed reached 163.41 Mbps, well above the global average (97.61 Mbps), ranking 34th globally.

- Mobile internet speed climbed to 134.19 Mbps, exceeding the global average (91.24 Mbps) and ranking 22nd globally – a 15-rank improvement from January 2024.

- Fiber-optic internet adoption reached 82.4% of households, surpassing the national target of 80% for the entire year.

- 5G deployment is a key priority, with Viettel launching its commercial network and reaching 5.5 million subscribers by early 2025 while VNPT has expanded 5G to all central areas of 63 provinces and cities.

- 33 data centers had been operated in Vietnam as of Q1 2025. The main data centre clusters are concentrated in Hanoi and Ho Chi Minh City. Local tech companies, including VNPT, Viettel, CMC and FPT, are expanding their data centres’ capacity.

Vietnam’s commitment to building advanced digital infrastructure is backed by strong national planning. The government is prioritizing telecom satellite development and upgrading the national network. The “Digital Infrastructure Strategy” approved in 2024, positions digital infrastructure as a key driver for economic growth, aiming for the digital economy to contribute 30% of GDP by 2030. The Vietnamese government is pushing for nationwide 5G rollout and investing in 6G research and space technology to accelerate economic and digital transformation. Strategic investments are also being channeled into expanding high-speed broadband and fixed-line networks, further strengthening Vietnam’s digital connectivity across urban and rural areas.

Vietnamese government’s investment incentives

Recognizing the immense potential of these sectors and aiming to attract greater foreign investment, the Vietnamese government is implementing significant incentives, particularly in the revised Telecoms Law set to fully take effect in 2025. The Vietnamese government is actively fostering foreign investment in high-tech sectors, especially data centers and cloud computing, as part of its broader digital transformation strategy. The revised law is specifically designed to streamline the investment process and remove key barriers for foreign entities:

- No capital contribution limits for foreign investors in data center construction. This removes a significant hurdle and encourages larger foreign investments.

- No prior licensing required — only capital registration needed to enter the market. Investors will only need to register their funding, significantly reducing bureaucratic delays and facilitating faster market entry.

- Shift to a post-audit mechanism by relevant government departments to ensure adherence to technical and environmental standards

The removal of ownership caps and the simplified registration process directly address previous concerns and are expected to entice more international operators to establish and expand their presence in Vietnam. This strategic focus on incentivizing foreign investment, alongside the continuous improvement of Vietnam’s underlying digital infrastructure, signals a strong commitment to establishing the nation as a leading technology hub in the region.

Potential challenges for foreign companies

As Vietnam’s technology sector continues its rapid expansion, it presents immense opportunities for foreign investors. However, navigating the country’s evolving regulatory landscape, talent challenges, and market dynamics requires an in-depth understanding and strategic planning.

- Talent shortage: Despite a young and growing workforce, Vietnam lacks specialized talent in AI, semiconductor engineering, and advanced IT fields. The rapid expansion of the tech sector has created fierce competition for skilled professionals, driving up recruitment costs.

- Regulatory complexity: Vietnam’s technology sector is undergoing regulatory changes, with emerging laws and regulations introduced to address data sovereignty, artificial intelligence (AI), and blockchain. Investors must ensure their target companies comply with industry-specific regulations to mitigate the risks of fines or legal challenges.

Need to understand more about Vietnam’s technology opportunities for your company?

Find your place in the Vietnamese market with GLOBAL ANGLE’s market research and business consulting services. With access to our local Vietnamese partner and team members, we are able to conduct business consulting. With our local researchers, we are able to conduct comprehensive on-the-ground market research.

View our previous work in the Vietnamese market

-

Site Visit: Research on Power Tools in Africa and Asia

-

Interview: Distribution Channel Structure for Electrical Materials in Asia

-

Beauty products receptivity study in Southeast Asia

-

Store Visit: Retail Supermarket Brand Comparison on Air Freshener, Deodorizer, and Insect repellent

-

In-Store Research: Supplement & Energy Drink Products

-

Company Listing: Potential Capital Alliance Partner

-

Google Trend research on global tire manufacturers in 25 countries

-

Research on Impact of Supply Chain Diversification in Smartphone manufacturing

-

Research on Smart Home Appliance Market in Thailand and Vietnam

-

Research on Premium Cosmetics and Skincare Market in Philippines and Vietnam